How to Use Technical Analysis to Navigate Market Corrections

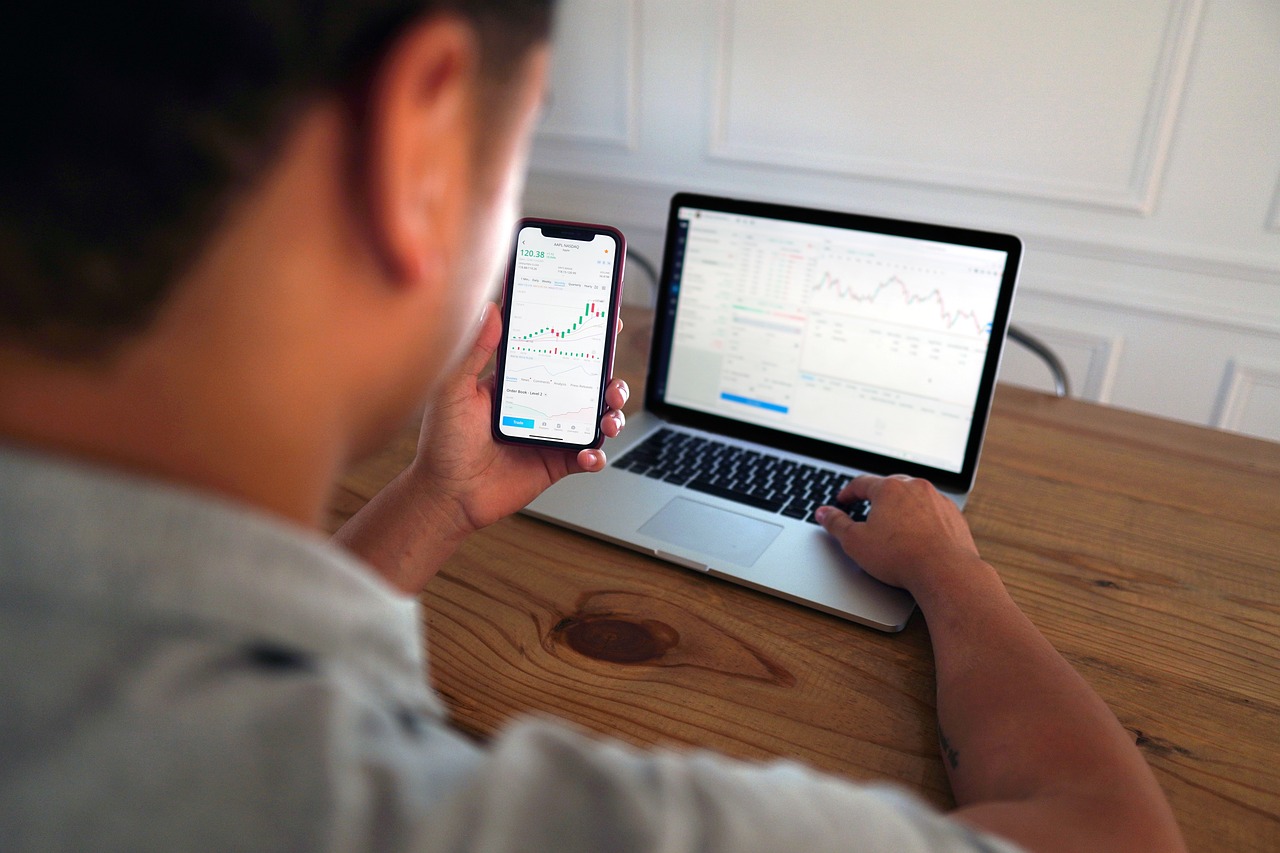

Market corrections can feel like a rollercoaster ride, right? One moment, you're riding high with profits, and the next, you're gripping the safety bar as prices take a sudden nosedive. But fear not! With the right tools and techniques, you can harness the power of technical analysis to navigate these turbulent waters. This article will explore how technical analysis can help you identify market corrections, make informed decisions, and develop strategies to mitigate risks during these volatile periods.

So, what exactly is a market correction? In simple terms, it's a temporary decline in the price of an asset or market, often defined as a drop of at least 10% from its recent peak. While this might sound alarming, corrections are a natural part of market cycles and can present unique opportunities for savvy traders and investors. Understanding the nature of these corrections and the psychology behind them is crucial for making smart trading decisions.

To effectively use technical analysis during market corrections, you need to familiarize yourself with key indicators and chart patterns that signal potential reversals. Think of these indicators as your compass, guiding you through the stormy seas of the market. By learning to read these signals, you can anticipate price movements and adjust your strategies accordingly.

As you dive deeper into technical analysis, you'll discover that it's not just about numbers and charts; it's about understanding the story behind the data. Each price movement reflects the collective sentiment of market participants, and by analyzing this sentiment, you can gain valuable insights into future price action. So, grab your analytical toolkit, and let's set sail into the world of technical analysis!

- What is a market correction? A market correction is a temporary decline in the price of an asset or market, typically defined as a drop of at least 10% from a recent peak.

- How can technical analysis help during corrections? Technical analysis helps identify market trends, potential reversals, and key support and resistance levels, allowing traders to make informed decisions.

- What are some key indicators to watch? Important indicators include Moving Averages, Relative Strength Index (RSI), and various chart patterns like Head and Shoulders.

- Why is volume analysis important? Analyzing trading volume alongside price movements provides context for market corrections, confirming the strength of price moves or reversals.

- How can I manage risk during market corrections? Implementing stop-loss orders and having a solid trading plan with defined entry and exit points can help protect your investments.

Understanding Market Corrections

Market corrections are a natural part of the financial landscape, akin to the ebb and flow of the tides. They represent temporary price declines in a market, typically defined as a drop of 10% or more from recent highs. Understanding these corrections is crucial for both traders and investors, as they can significantly influence market sentiment and investment strategies. Just like a sudden storm can disrupt a calm sea, a market correction can shake investor confidence, leading to panic selling and further declines.

So, what causes these corrections? They can stem from various factors, including economic data releases, geopolitical events, or even changes in investor sentiment. For instance, if a company reports lower-than-expected earnings, it may trigger a sell-off, leading to a correction. Similarly, broader economic indicators, such as rising unemployment rates or inflation, can also spark fears of an impending downturn, prompting investors to reassess their positions.

During a market correction, it's essential to recognize that not all declines are created equal. Some corrections may be short-lived, while others can signal a more prolonged downturn. Understanding the difference can help investors make informed decisions. Here are a few key points to consider:

- Market Sentiment: Pay attention to the mood of the market. Are investors panicking, or is there a sense of cautious optimism?

- Historical Context: Look at past corrections to gauge potential recovery times and patterns.

- Fundamental Analysis: Analyze underlying economic conditions that might be driving the correction.

In summary, market corrections are not just bumps in the road; they are vital signals that can provide valuable insights into market health. By understanding their nature and causes, traders and investors can better navigate these turbulent waters, adjusting their strategies to mitigate risks and seize opportunities. Just remember, while corrections can be unsettling, they also offer a chance to reassess your portfolio and make more informed investment choices.

Key Technical Indicators

When it comes to navigating the tumultuous waters of market corrections, understanding is like having a trusty compass in a storm. These indicators serve as vital tools for traders and investors, helping them gauge market trends, identify potential reversals, and make informed decisions. By familiarizing yourself with these indicators, you can enhance your ability to effectively navigate corrections and mitigate risks. Let’s dive into some of the most essential technical indicators that every trader should know.

Among the most widely used technical indicators are moving averages. They are designed to smooth out price data over a specific period, making it easier to identify trends. Think of moving averages as a way to filter out the 'noise' of daily price fluctuations, allowing you to focus on the bigger picture. During market corrections, moving averages can help pinpoint potential support and resistance levels, guiding traders on when to enter or exit positions.

The Simple Moving Average (SMA) calculates the average price over a defined period, such as 20, 50, or 200 days. This straightforward approach makes it a fundamental tool for recognizing trends and potential reversal points. For instance, if the price crosses above the SMA, it may signal a bullish trend, while a drop below could indicate bearish sentiment. Traders often use multiple SMAs to identify crossovers, which can serve as buy or sell signals.

On the other hand, the Exponential Moving Average (EMA) gives more weight to recent prices, making it more responsive to new information. This characteristic can be particularly useful in fast-moving markets where conditions change rapidly. For example, if a stock's price surges quickly, the EMA will react more swiftly than the SMA, providing traders with timely insights. Understanding how to leverage both SMA and EMA can significantly enhance your trading strategy during market corrections.

Another critical indicator is the Relative Strength Index (RSI), which measures the speed and change of price movements. Ranging from 0 to 100, the RSI helps identify overbought or oversold conditions in the market. Typically, an RSI above 70 indicates that an asset may be overbought, while an RSI below 30 suggests it may be oversold. These signals can be invaluable during market corrections, as they can hint at potential reversals or continuations of trends.

Incorporating these key technical indicators into your trading arsenal can significantly enhance your ability to navigate corrections. By understanding how to interpret moving averages, RSI, and other indicators, you can make more informed decisions, minimize risks, and potentially capitalize on market opportunities. Remember, the key to successful trading lies not just in knowing these indicators but in knowing how to apply them effectively in real-time market conditions.

Q: What is the best technical indicator for beginners?

A: The Simple Moving Average (SMA) is often recommended for beginners due to its straightforward calculation and clear signals.

Q: How can I combine multiple indicators for better results?

A: Many traders use a combination of indicators, such as moving averages with the RSI, to confirm signals and enhance decision-making.

Q: Are technical indicators foolproof?

A: No, technical indicators are not foolproof. They are tools that provide insights, but they should be used in conjunction with other analysis methods and risk management strategies.

Moving Averages

Moving averages are crucial tools in the arsenal of any trader looking to navigate the turbulent waters of market corrections. They function by smoothing out price data over a specified period, which helps traders identify the direction of the trend more clearly. Imagine trying to catch a wave while surfing; you need to understand the rhythm of the ocean to ride it successfully. Similarly, moving averages help you catch the trend wave before it crashes down.

There are two primary types of moving averages that traders commonly use: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). Each serves a unique purpose and can provide different insights into market behavior. The SMA offers a straightforward calculation, averaging prices over a set time frame, while the EMA gives more weight to recent prices, making it more responsive to new information. This responsiveness can be particularly beneficial in fast-moving markets where conditions can change in the blink of an eye.

| Type of Moving Average | Description | Best Used For |

|---|---|---|

| Simple Moving Average (SMA) | Averages prices over a defined period. | Identifying long-term trends. |

| Exponential Moving Average (EMA) | Gives more weight to recent prices. | Spotting short-term price movements. |

By utilizing moving averages, traders can also identify potential support and resistance levels during market corrections. For instance, when the price of an asset approaches its SMA, it may indicate a support level where buyers step in. Conversely, if the price is hovering around the EMA and starts to decline, it might signal a resistance level where sellers are likely to take action. This dynamic interplay can be likened to a game of tug-of-war, where the market's bulls and bears are constantly vying for control.

Moreover, moving averages can be used in conjunction with other technical indicators to create a more comprehensive trading strategy. For example, a trader might wait for the EMA to cross above the SMA, a phenomenon known as a "golden cross," which often signals a bullish trend. Conversely, when the EMA crosses below the SMA, known as a "death cross," it can indicate a bearish trend. Understanding these crossovers can be the difference between riding the wave to profit or getting wiped out in a market correction.

In conclusion, moving averages are not just numbers on a chart; they are vital indicators that help traders make informed decisions during market corrections. By mastering their use, traders can enhance their ability to navigate the choppy waters of the financial markets, ultimately leading to more successful trading outcomes.

- What is the main difference between SMA and EMA? The SMA calculates the average price over a specific period, while the EMA gives more weight to recent prices, making it more sensitive to new price movements.

- How can I use moving averages in my trading strategy? You can use moving averages to identify trends, support and resistance levels, and potential entry and exit points based on crossovers.

- Are moving averages effective during all market conditions? While moving averages can be helpful, they are most effective in trending markets. In sideways or choppy markets, they may produce false signals.

Simple Moving Average (SMA)

The is one of the most fundamental tools in technical analysis, and it serves as a cornerstone for many traders' strategies. Essentially, the SMA calculates the average price of a security over a specified number of periods, which smooths out fluctuations in price and helps identify the underlying trend. For instance, if you're looking at a 10-day SMA, it takes the average of the closing prices of the last 10 days and updates this average daily. This means that as new data comes in, the oldest data drops out, ensuring that your analysis stays relevant and reflective of current market conditions.

One of the key benefits of using the SMA is its ability to highlight areas of potential support and resistance. When the price of a stock is above its SMA, it indicates a bullish trend, while a price below the SMA suggests a bearish trend. Traders often use these moving averages to make informed decisions about when to enter or exit positions. For example, if the price crosses above the SMA, it could be a signal to buy, whereas a cross below might indicate it's time to sell.

However, it's important to remember that while the SMA is a powerful tool, it has its limitations. Because it is based on historical data, it can lag behind current price movements. This lag can lead to delayed signals, which might cause traders to miss out on opportunities. To counteract this, many traders use the SMA in conjunction with other indicators, such as the Exponential Moving Average (EMA) or the Relative Strength Index (RSI), to create a more comprehensive trading strategy.

To give you a clearer picture of how the SMA works, here’s a simple example:

| Day | Closing Price | 10-Day SMA |

|---|---|---|

| 1 | $10 | |

| 2 | $11 | |

| 3 | $12 | |

| 4 | $13 | |

| 5 | $14 | |

| 6 | $15 | |

| 7 | $16 | |

| 8 | $17 | |

| 9 | $18 | |

| 10 | $19 | $14.5 |

In this example, the 10-day SMA on Day 10 is calculated by taking the average of the closing prices from Days 1 to 10. As you can see, the SMA provides a clearer view of the price trend, which can be incredibly useful for making trading decisions. Overall, incorporating the SMA into your trading toolkit can enhance your ability to navigate market corrections and capitalize on emerging trends.

- What is the main purpose of using an SMA?

The primary purpose of the SMA is to identify the direction of the trend over a specified period, helping traders make informed decisions. - How do I choose the right period for an SMA?

The choice of period depends on your trading style. Shorter periods (like 10 days) are more responsive to price changes, while longer periods (like 50 or 200 days) smooth out fluctuations. - Can I use SMA for day trading?

Yes, many day traders use short-term SMAs to identify quick entry and exit points in the market. - What are the limitations of using SMA?

SMAs can lag behind current prices, which may result in delayed signals. It's often beneficial to use them alongside other indicators.

Exponential Moving Average (EMA)

The is a powerful tool in the arsenal of traders and investors looking to navigate the often tumultuous waters of market corrections. Unlike the Simple Moving Average (SMA), which treats all price points equally, the EMA places a greater emphasis on recent price movements. This characteristic makes the EMA particularly responsive to new information, which is crucial in fast-moving markets. Imagine trying to catch a wave; the EMA is like a surfer who knows just when to paddle hard to catch the best swell, while the SMA is more like a leisurely swimmer who might miss the action.

The calculation of the EMA involves a bit of math, but don’t let that intimidate you! It uses a smoothing factor that determines how much weight to give to the most recent prices. The formula is as follows:

EMA (Current Price x K) + (Previous EMA x (1 - K)) Where: K 2 / (N + 1) N Number of periods

This means that the more periods you choose, the less weight the most recent price will have. Traders often use the 12-day and 26-day EMAs for short-term analysis, while the 50-day and 200-day EMAs are popular for longer-term trends. By comparing these different EMAs, traders can identify potential buy or sell signals. For instance, when the short-term EMA crosses above the long-term EMA, it may signal a bullish trend, while a cross below may indicate a bearish trend. This crossover strategy is often referred to as the "Golden Cross" and "Death Cross."

One of the most significant advantages of using the EMA during market corrections is its ability to act as a dynamic support or resistance level. As prices fluctuate, the EMA can provide a visual representation of where the market might find support or face resistance. This is particularly useful during volatile periods when prices can swing wildly. For example, if the price approaches the EMA from below, it might find support there, suggesting a potential buying opportunity. Conversely, if the price approaches from above, it may face resistance, indicating a possible selling point.

To sum it up, the EMA is not just another line on a chart; it’s a vital indicator that can help you make informed trading decisions. By understanding how to use the EMA effectively, you can increase your chances of riding the waves of market corrections rather than getting swept away. Whether you’re a seasoned trader or just starting out, incorporating the EMA into your technical analysis toolkit can enhance your market navigation skills significantly.

- What is the main difference between EMA and SMA? The EMA gives more weight to recent prices, making it more responsive to new information, while the SMA treats all prices equally.

- How can I use EMA in my trading strategy? You can use EMA to identify trends and potential reversal points, as well as dynamic support and resistance levels.

- What periods are commonly used for EMA? Traders often use 12-day and 26-day EMAs for short-term analysis and 50-day and 200-day EMAs for long-term trends.

Relative Strength Index (RSI)

The is a powerful momentum oscillator that measures the speed and change of price movements. Developed by J. Welles Wilder Jr., this indicator is designed to identify overbought or oversold conditions in a market, helping traders make informed decisions during volatile periods. The RSI ranges from 0 to 100 and is typically plotted on a chart beneath the price action. A common interpretation of the RSI is that readings above 70 indicate an overbought condition, while readings below 30 suggest an oversold condition.

Understanding how to use the RSI effectively can be a game changer for traders looking to navigate market corrections. When the RSI approaches the extremes of its range, it can signal potential reversals, allowing traders to adjust their strategies accordingly. For instance, if the RSI crosses above the 70 mark, it may be a warning sign that the asset is overbought and could be due for a price correction. Conversely, when the RSI dips below 30, it might indicate that the asset is oversold, presenting a potential buying opportunity.

To illustrate the effectiveness of the RSI, let’s consider a hypothetical scenario. Imagine you’re tracking a stock that has been on a remarkable upward trajectory. As the price climbs, you notice the RSI creeping above the 70 threshold. This could be your cue to consider taking profits or tightening your stop-loss orders. On the flip side, if the stock experiences a sharp decline and the RSI falls below 30, it might be an opportune moment to enter the market, expecting a rebound.

However, it’s essential to remember that the RSI should not be used in isolation. Combining it with other technical indicators and chart patterns can provide a more comprehensive view of market dynamics. For example, if the RSI indicates that a stock is oversold but other indicators suggest a bearish trend, it may be wise to exercise caution. This multi-faceted approach can help mitigate risks and enhance your trading decisions.

In addition to identifying overbought and oversold conditions, traders can also look for divergences between the RSI and price action. A divergence occurs when the price makes a new high or low, but the RSI does not follow suit. This discrepancy can signal a potential reversal, providing an additional layer of insight into market corrections.

Overall, the RSI is a versatile tool that can significantly enhance your trading strategy. By understanding its signals and integrating it with other analysis techniques, you can better navigate the complexities of market corrections and make more informed trading decisions.

- What is the best RSI setting for trading? The default setting for the RSI is 14 periods, but traders can adjust this based on their trading style and the time frame they are analyzing.

- Can the RSI be used in all markets? Yes, the RSI can be applied to any market, including stocks, forex, and commodities, making it a versatile tool for traders.

- How often should I check the RSI? The frequency of checking the RSI depends on your trading strategy. Day traders may check it multiple times a day, while swing traders may look at it daily or weekly.

Chart Patterns to Watch

When it comes to technical analysis, chart patterns are invaluable tools that can help traders anticipate market behavior and corrections. Recognizing these patterns is like having a roadmap in a foggy landscape; they give clarity and direction amidst uncertainty. By understanding and identifying common chart formations, investors can make informed decisions that could save them from significant losses during volatile periods.

One of the most prominent patterns to watch for is the Head and Shoulders formation. This pattern typically indicates a reversal in trend, signaling that a bullish market may soon shift into a bearish one. Imagine a mountain range where the middle peak (the head) is taller than the two surrounding peaks (the shoulders). When traders spot this pattern, they often prepare for potential market corrections, positioning themselves to either exit their trades or short the market. The key to successfully trading this pattern lies in identifying the neckline, which acts as a support level. A break below this line can confirm the reversal, sending traders into action.

Another significant pattern to be aware of is the Double Top and Double Bottom. These formations are like two waves crashing against a shore, indicating strong buying or selling pressure. A double top occurs after an upward trend, where the price peaks twice at a similar level before reversing downward. Conversely, a double bottom signals a potential bullish reversal after a downtrend, where the price dips twice at a similar low before bouncing back up. Recognizing these formations can enhance your decision-making process during volatile periods, allowing you to capitalize on market movements.

To further illustrate the importance of chart patterns, let’s take a look at a simple table summarizing these key patterns:

| Chart Pattern | Indication | Action |

|---|---|---|

| Head and Shoulders | Trend reversal from bullish to bearish | Consider selling or shorting |

| Double Top | Potential bearish reversal | Prepare to sell |

| Double Bottom | Potential bullish reversal | Consider buying |

In addition to these patterns, traders should also keep an eye on flags and pennants. These are continuation patterns that suggest a brief pause in the prevailing trend before it resumes. Think of them as a pit stop in a race; they allow traders to reassess their strategies before the market takes off again. Flags typically appear as rectangular shapes that slope against the prevailing trend, while pennants form after a strong price movement and look like small symmetrical triangles. Recognizing these patterns can help you make timely decisions to either ride the wave or pull back for a moment.

Ultimately, understanding chart patterns is about being proactive rather than reactive. By familiarizing yourself with these formations and their implications, you can develop a keen sense of market dynamics. This knowledge not only enhances your trading strategies but also builds your confidence in navigating the unpredictable waters of market corrections.

- What is a chart pattern in technical analysis? Chart patterns are formations created by the price movements of a security on a chart. They help traders predict future price movements based on historical data.

- How do I identify a Head and Shoulders pattern? Look for three peaks: two smaller peaks on either side of a larger peak. The line connecting the lows of the two smaller peaks is known as the neckline.

- Can I rely solely on chart patterns for trading decisions? While chart patterns are useful, they should be used in conjunction with other technical indicators and fundamental analysis for more informed decision-making.

Head and Shoulders

The pattern is one of the most recognized and reliable reversal patterns in technical analysis. It typically appears at the top of an uptrend and signals a potential shift in market sentiment. Imagine a mountain range where the middle peak is significantly taller than the surrounding hills; this is exactly what the Head and Shoulders pattern resembles. The formation consists of three peaks: the left shoulder, the head, and the right shoulder. Let's break it down:

- Left Shoulder: This is formed when the price rises to a peak and then declines, creating a local high.

- Head: The price then rises again, surpassing the previous peak to form the highest point of the pattern, known as the head.

- Right Shoulder: Finally, the price drops again before making one last rise, which peaks lower than the head, forming the right shoulder.

Traders often look for this pattern as it provides a clear indication of a potential trend reversal. The key to successfully identifying a Head and Shoulders pattern lies in the neckline, which is drawn by connecting the lowest points of the two troughs formed between the shoulders. A breakout below this neckline confirms the reversal, indicating that it’s time to consider short positions or exit long positions.

To illustrate this, let’s consider a hypothetical scenario:

| Stage | Price Movement | Market Sentiment |

|---|---|---|

| Left Shoulder | Price rises to $100, then drops to $90 | Optimistic, but starting to show signs of fatigue |

| Head | Price rises to $110, then drops to $95 | Peak optimism, followed by a realization of overvaluation |

| Right Shoulder | Price rises to $105, then drops below $90 | Pessimism sets in as the market begins to correct |

Once the price breaks below the neckline, it often signals a significant shift in market dynamics. This is where traders can capitalize on the anticipated downtrend. However, like any trading strategy, it’s essential to combine the Head and Shoulders pattern with other indicators and analysis to improve accuracy and reduce risks.

In summary, the Head and Shoulders pattern is an invaluable tool for traders looking to navigate market corrections. By recognizing this pattern early and understanding its implications, you can make more informed decisions and enhance your trading strategy. Remember, the market is much like a game of chess; anticipating your opponent's moves can give you the upper hand. So, keep an eye out for those peaks and troughs, and you might just find yourself ahead in the game!

Q: How reliable is the Head and Shoulders pattern?

A: While the Head and Shoulders pattern is considered a reliable reversal signal, no pattern is foolproof. It’s essential to use it in conjunction with other technical indicators for better accuracy.

Q: What should I do if I identify a Head and Shoulders pattern?

A: If you identify a Head and Shoulders pattern, consider placing a sell order once the price breaks below the neckline, and always use stop-loss orders to manage risk.

Q: Can the Head and Shoulders pattern appear in any market?

A: Yes, the Head and Shoulders pattern can appear in any market, including stocks, forex, and commodities. However, its effectiveness may vary based on market conditions.

Double Tops and Bottoms

The patterns are among the most significant reversal signals in technical analysis. Understanding these formations can provide traders with critical insights into potential market corrections. A Double Top occurs when the price reaches a high point twice, failing to break through the resistance level between the peaks. This pattern often indicates that the upward momentum is weakening, suggesting a potential reversal to the downside. Conversely, a Double Bottom forms when the price hits a low point twice, with a support level holding firm between the dips. This pattern signals that the downward trend may be losing steam, paving the way for a bullish reversal.

To visualize these patterns better, consider the following table that outlines the characteristics of both formations:

| Pattern | Formation | Indication |

|---|---|---|

| Double Top | Two peaks at similar price levels | Potential bearish reversal |

| Double Bottom | Two troughs at similar price levels | Potential bullish reversal |

Recognizing these patterns can be a game-changer for traders. For instance, if you spot a Double Top, it might be wise to consider selling or shorting your position, as the market could be poised for a decline. On the flip side, a Double Bottom might signal the perfect opportunity to enter a long position, anticipating a price increase.

Moreover, it’s essential to combine these patterns with other technical indicators for a more robust analysis. For example, using the Relative Strength Index (RSI) alongside Double Tops and Bottoms can help confirm overbought or oversold conditions, enhancing the reliability of your trading decisions. In the end, recognizing these patterns not only aids in anticipating market corrections but also empowers traders to make informed decisions that align with their overall trading strategies.

- What is a Double Top pattern?

A Double Top pattern forms when the price reaches a peak twice, indicating a potential reversal from an uptrend to a downtrend.

- What does a Double Bottom pattern signify?

A Double Bottom pattern occurs when the price hits a low twice, suggesting a potential reversal from a downtrend to an uptrend.

- How can I confirm a Double Top or Bottom?

Using additional indicators like the RSI or moving averages can help confirm the strength of the Double Top or Bottom pattern.

Volume Analysis

When it comes to navigating the tumultuous waters of market corrections, serves as a lighthouse guiding traders through the fog. Understanding how trading volume interacts with price movements can unveil critical insights about market sentiment and potential reversals. Think of volume as the pulse of the market; when it spikes, it's like a heartbeat racing with excitement or fear, signaling that something significant is happening beneath the surface.

To effectively analyze volume, it's essential to consider it alongside price movements. For instance, if a stock's price rises with increased volume, it often indicates strong buyer interest, suggesting that the upward trend may continue. Conversely, if prices rise but volume decreases, it could signal a weakening trend, hinting that a correction might be on the horizon. This relationship can be illustrated in the following table:

| Price Movement | Volume Movement | Market Sentiment |

|---|---|---|

| Price Up | Volume Up | Strong Bullish Sentiment |

| Price Up | Volume Down | Weak Bullish Sentiment |

| Price Down | Volume Up | Strong Bearish Sentiment |

| Price Down | Volume Down | Weak Bearish Sentiment |

Another crucial aspect of volume analysis is recognizing volume spikes. These spikes often indicate a surge of interest in a stock or market, typically preceding corrections. For example, if you observe a sudden spike in volume during a downtrend, it might suggest that investors are starting to panic, potentially leading to a sharp price drop. In contrast, a volume spike during an uptrend can signal a rush of buying, which might push prices higher.

Additionally, monitoring volume trends over time can provide valuable context for understanding market behavior. A decline in volume during a price drop may indicate a weakening bearish momentum, suggesting that the selling pressure could be easing and a recovery might be on the way. By observing these trends, traders can make more informed decisions about when to enter or exit positions during market corrections.

In summary, volume analysis is a powerful tool that can significantly enhance your trading strategy. By paying attention to the interplay between price movements and trading volume, you can better gauge market sentiment, anticipate potential corrections, and make more informed trading decisions. Remember, in the world of trading, knowledge is power, and understanding volume dynamics can provide you with a competitive edge.

- What is the significance of volume in trading?

Volume indicates the number of shares traded during a specific period. High volume can signal strong interest in a stock, while low volume might suggest a lack of interest. - How can I use volume analysis to improve my trading?

By observing the relationship between price movements and volume, you can identify trends and reversals, helping you make more informed trading decisions. - What are volume spikes, and why are they important?

Volume spikes are sudden increases in trading activity that can indicate significant market sentiment changes. They often precede price corrections or reversals. - Can volume trends predict market corrections?

Yes, analyzing volume trends can provide insights into market behavior, helping you anticipate potential corrections based on changes in buying or selling pressure.

Volume Spikes

Volume spikes are like the loud cheers in a quiet stadium; they signal something significant is happening in the market. When you see a sudden increase in trading volume, it often indicates heightened interest in a particular stock or asset. This surge can be a precursor to price corrections, making it essential for traders to pay close attention. Think of volume spikes as flashing lights that draw your attention to potential changes in market dynamics.

Understanding the implications of volume spikes can help you make informed trading decisions. For instance, a spike in volume during a price increase can confirm the strength of a bullish trend, suggesting that the price may continue to rise. Conversely, if a volume spike occurs during a price drop, it can indicate panic selling or a shift in market sentiment, hinting at a possible correction ahead. This is why monitoring volume alongside price movements is crucial.

To effectively analyze volume spikes, consider these key aspects:

- Magnitude: The size of the spike compared to average volume levels can indicate the strength of the move.

- Price Movement: Observe how the price reacts during and after the volume spike. A price increase with high volume is generally a positive signal.

- Market Context: Always consider the broader market conditions. A volume spike in a bear market may carry different implications than in a bull market.

In summary, volume spikes serve as vital indicators in technical analysis, offering insights that can help traders anticipate market corrections. By integrating volume analysis into your trading strategy, you can enhance your ability to navigate volatile periods effectively.

- What is a volume spike? A volume spike refers to a significant increase in the number of shares traded for a particular stock or market, indicating heightened interest or activity.

- How can I identify a volume spike? You can identify a volume spike by comparing the current trading volume to the average volume over a set period. A volume that exceeds this average significantly is considered a spike.

- What does a volume spike indicate? A volume spike can indicate strong buying or selling pressure, suggesting potential price movements or corrections.

- Should I always act on volume spikes? While volume spikes can provide valuable insights, it's essential to consider them in conjunction with other technical indicators and market context before making trading decisions.

Volume Trends

When it comes to navigating market corrections, understanding is like having a secret map that guides you through the fog. Volume, in essence, refers to the number of shares or contracts traded in a given period, and it can reveal a lot about market sentiment. For instance, if you notice a significant decline in price accompanied by a drop in volume, it might indicate that the selling pressure is weakening. This could potentially signal a recovery is on the horizon. Conversely, if prices are falling while volume is surging, it often suggests that the market is experiencing strong bearish momentum, which can lead to further declines.

To grasp volume trends effectively, consider the following aspects:

- Volume Patterns: Analyzing historical volume patterns can provide context for current market behavior. For example, if a stock typically experiences high volume during earnings reports, a sudden drop in volume outside of this period could be a red flag.

- Comparative Analysis: Compare current volume levels to historical averages to gauge whether the current trading activity is significant. A spike above the average volume might indicate a strong interest in a stock, which can precede a price correction or reversal.

- Price-Volume Relationship: Always pay attention to how volume correlates with price movements. A price increase on low volume might not be sustainable, while a price increase on high volume can indicate strong buying interest.

Incorporating volume trends into your trading strategy can enhance your ability to make informed decisions during market corrections. For instance, a trader might look for a convergence of rising prices and increasing volume as a confirmation of a bullish trend. On the flip side, if prices are falling and volume is decreasing, it could be a sign that the bearish trend is losing steam, potentially indicating a buying opportunity.

Ultimately, by keeping a keen eye on volume trends, you can better understand the underlying dynamics of market movements. This knowledge not only helps in identifying potential corrections but also aids in making timely decisions that can protect your investments and enhance your trading outcomes.

What is volume in trading?

Volume refers to the number of shares or contracts traded in a security or market during a given period. It is a key indicator of market activity and liquidity.

How can I analyze volume trends?

You can analyze volume trends by looking at historical volume data, comparing current volume levels to averages, and observing the relationship between price movements and volume changes.

Why are volume trends important during market corrections?

Volume trends provide insights into market sentiment and can help traders identify the strength or weakness of price movements, which is crucial during volatile periods.

What should I do if I see a volume spike?

A volume spike can indicate heightened interest in a stock. Depending on the context, it may signal a potential price reversal or correction. It's essential to analyze accompanying price movements and other indicators before making decisions.

Setting Stop-Loss Orders

When navigating the turbulent waters of market corrections, one of the most critical tools in your trading arsenal is the stop-loss order. Think of it as a safety net that catches you before you fall too far. Essentially, a stop-loss order is an instruction to sell a security when it reaches a certain price, helping to limit potential losses. In times of market volatility, having a well-defined stop-loss strategy can save your portfolio from significant downturns. But how do you set these orders effectively?

First, it’s essential to determine your risk tolerance. This is the amount of loss you are willing to accept before exiting a position. Knowing this will guide you in establishing your stop-loss levels. For instance, if you buy a stock at $100 and are comfortable risking 10%, you would set your stop-loss at $90. This way, if the stock price drops to $90, your order triggers, and you exit the position to prevent further losses.

Moreover, stop-loss orders can be influenced by various factors, including support levels and market volatility. Support levels are price points where a stock tends to stop falling and may even rebound. By setting your stop-loss just below a significant support level, you can give your trade a little breathing room while still protecting your investment. Conversely, if the market is particularly volatile, you might want to widen your stop-loss to avoid being stopped out prematurely due to normal price fluctuations.

Another important aspect to consider is the type of stop-loss order you want to use. There are several options available:

- Standard Stop-Loss: This order sells your stock at the market price once your stop-loss level is hit.

- Trailing Stop-Loss: This dynamic order adjusts as the stock price moves in your favor, locking in profits while still providing a safety net.

- Guaranteed Stop-Loss: This type guarantees your exit at the specified price, even in fast-moving markets, but may come with higher fees.

As you develop your stop-loss strategy, it’s also crucial to remain flexible. Market conditions can change rapidly, and what works one day might not be effective the next. Therefore, regularly reviewing and adjusting your stop-loss orders is vital. For example, if a stock rises significantly, you may want to move your stop-loss order up to lock in profits and protect against a sudden downturn.

In conclusion, setting stop-loss orders is not just a precaution; it's a strategic move that can help you maintain control over your trading outcomes. By carefully determining your stop-loss levels based on your risk tolerance, market conditions, and the type of order you choose, you can navigate market corrections with greater confidence and resilience.

Q1: What is a stop-loss order?

A stop-loss order is a trading tool that automatically sells a security when it reaches a specified price, helping to limit potential losses.

Q2: How do I determine my stop-loss level?

To determine your stop-loss level, assess your risk tolerance and consider key technical indicators like support levels.

Q3: Can I adjust my stop-loss order?

Yes, you can and should adjust your stop-loss orders as market conditions change to protect your investments effectively.

Q4: What is the difference between a standard stop-loss and a trailing stop-loss?

A standard stop-loss order sells at a fixed price, while a trailing stop-loss moves with the stock price, allowing for profit locking as the price increases.

Determining Stop-Loss Levels

Setting effective stop-loss levels is crucial for safeguarding your investments during market corrections. A stop-loss order is a predefined exit point that automatically sells your asset when it reaches a specified price, helping you limit potential losses. But how do you determine the right level for your stop-loss? It’s not just a matter of picking a random number; it requires a careful analysis of market conditions, technical indicators, and your personal risk tolerance.

One common approach is to use support levels as a benchmark for setting your stop-loss. Support levels are price points where an asset tends to stop falling and may even bounce back. By placing your stop-loss slightly below these levels, you can protect yourself against minor fluctuations while still allowing for potential recovery. For instance, if a stock has consistently bounced off $50, you might set your stop-loss at $48. This way, you give the stock some room to maneuver without exposing yourself to excessive risk.

Another method is to consider volatility measures. Assets that are more volatile will naturally have larger price swings, and setting a stop-loss too close to the current price can lead to premature selling. A common technique is to use the Average True Range (ATR), which measures market volatility. For example, if the ATR for a stock is $2, you might set your stop-loss at 1.5 times the ATR below the current price. This approach helps ensure that your stop-loss is set at a level that accounts for normal price fluctuations, reducing the chances of being stopped out during a temporary dip.

Here’s a quick summary of factors to consider when determining your stop-loss levels:

- Support Levels: Place your stop-loss below significant support levels to avoid being stopped out during minor fluctuations.

- Volatility Measures: Use indicators like ATR to account for price swings in volatile markets.

- Risk Tolerance: Assess how much loss you are willing to accept and set your stop-loss accordingly.

Ultimately, the key to determining stop-loss levels lies in a combination of technical analysis and personal risk management. Regularly reviewing and adjusting these levels in response to changing market conditions ensures that you remain protected and can navigate corrections with confidence. Remember, the goal is not just to minimize losses, but to maintain a disciplined approach that enables you to stay in the game even during turbulent times.

Q: What is a stop-loss order?

A stop-loss order is an instruction to sell an asset when it reaches a certain price, helping to limit potential losses.

Q: How do I choose the right stop-loss level?

Consider using support levels and volatility measures like the Average True Range (ATR) to set your stop-loss at a strategic point.

Q: Can I adjust my stop-loss order?

Yes, you can and should adjust your stop-loss order based on changing market conditions and your trading strategy.

Adjusting Stop-Loss Orders

In the ever-fluctuating world of trading, can be your lifeline during market corrections. Think of stop-loss orders as your safety net; they help you manage risk and protect your investments from significant losses. However, merely setting them and forgetting about them is not enough. As market conditions change, so should your stop-loss strategy. This adaptability can mean the difference between a minor setback and a major financial blow.

When you first enter a trade, you should establish a stop-loss level based on your technical analysis. This initial placement is crucial, but as the market evolves, you need to revisit it. For instance, if the price of an asset begins to rise significantly, you might consider trailing your stop-loss order higher. This means adjusting your stop-loss level to lock in profits while still allowing for potential upward movement. It’s like riding a wave; you want to stay on top while minimizing the risk of falling off.

Moreover, it’s essential to consider the volatility of the asset you’re trading. If a stock is particularly volatile, you may want to set a wider stop-loss to avoid being prematurely knocked out of a trade by normal price fluctuations. Conversely, for less volatile assets, a tighter stop-loss might be appropriate. Understanding the nature of the asset you’re trading is key to making these adjustments effectively.

Another important aspect of adjusting stop-loss orders involves market sentiment. If you notice a shift in market sentiment—perhaps due to news, earnings reports, or broader economic indicators—it may be wise to reassess your stop-loss levels. For instance, if a company releases positive earnings and the stock price surges, adjusting your stop-loss to a higher level can help secure your gains. Conversely, if negative news emerges, you might want to tighten your stop-loss to protect against potential downturns.

In summary, adjusting stop-loss orders is not just about protecting your capital but also about enhancing your trading strategy. It requires a keen eye on market conditions, an understanding of the asset's behavior, and a willingness to adapt. By actively managing your stop-loss levels, you can navigate market corrections more effectively and safeguard your investments against unforeseen volatility.

- What is a stop-loss order? A stop-loss order is a predetermined price level at which a trader will sell an asset to prevent further losses.

- How often should I adjust my stop-loss orders? It's advisable to review and adjust your stop-loss orders regularly, especially in response to significant market movements or changes in volatility.

- Can I set multiple stop-loss orders for one trade? Yes, you can set multiple stop-loss orders at different levels to manage risk more effectively.

Developing a Trading Plan

Creating a well-structured trading plan is essential for navigating the unpredictable waters of market corrections. Think of it as your roadmap, guiding you through the twists and turns of the market landscape. Without a clear plan, you might find yourself lost, making impulsive decisions that could lead to significant losses. A solid trading plan should encompass several key elements, including entry and exit strategies, risk management protocols, and criteria for reevaluating your positions. So, how do you go about crafting this all-important plan?

First, let’s talk about entry and exit points. Clearly defining when to enter or exit a trade is crucial. It’s not just about jumping in when you feel the market is right; it’s about using technical analysis to pinpoint specific moments when the odds are in your favor. For instance, if you notice a stock bouncing off a significant support level, that might be your cue to buy. Conversely, if the price hits a resistance level, it could be time to sell. By having these points mapped out in advance, you can maintain discipline and avoid emotional trading.

Next, let’s touch on risk management strategies. This is where you can protect your capital from the unpredictable nature of market corrections. A good rule of thumb is to never risk more than a small percentage of your total trading capital on a single trade. This way, even if you face a string of losses, you won’t wipe out your entire account. Techniques like position sizing and diversification can be your best friends here. For example, instead of putting all your eggs in one basket, consider spreading your investments across different sectors or asset classes. This can cushion the blow during market downturns.

Another vital aspect of your trading plan is the need for adaptability. The markets are constantly changing, and so should your strategies. Regularly reevaluating your positions based on new information or changing market conditions is essential. You might find that the initial reasons for entering a trade no longer hold true, and that’s okay! A flexible approach allows you to pivot quickly and minimize potential losses.

Lastly, let’s not forget the importance of documenting your trading plan. Write it down, and make sure it’s easily accessible. This not only gives you a clear reference point but also holds you accountable. When the market gets choppy, you can always return to your plan to remind yourself of your goals and strategies.

In summary, developing a comprehensive trading plan involves defining your entry and exit points, implementing robust risk management strategies, ensuring adaptability to market changes, and documenting your plan for accountability. By following these steps, you can navigate market corrections with greater confidence and a clearer sense of direction.

- What is a trading plan? A trading plan is a documented strategy that outlines your trading goals, risk management rules, and specific entry and exit criteria.

- Why is a trading plan important? A trading plan helps you stay disciplined and make informed decisions, especially during volatile market conditions.

- How often should I review my trading plan? It's advisable to review your trading plan regularly, especially after significant market movements or changes in your trading strategy.

- Can I modify my trading plan? Absolutely! Flexibility is key in trading. If market conditions change, be prepared to adjust your plan accordingly.

Defining Entry and Exit Points

When it comes to trading, defining entry and exit points is like drawing a roadmap before embarking on a journey. Without a clear plan, you might find yourself lost in the twists and turns of the market. The key is to rely on technical analysis to identify these crucial points, ensuring that your decisions are not just based on gut feelings but on solid data.

To establish effective entry points, traders often look for specific signals that indicate a favorable moment to buy. This could be a breakout above a resistance level or a bullish reversal pattern signaling a potential upward trend. For instance, if the price of a stock consistently bounces off a particular support level, that could be an ideal entry point. It's vital to combine these signals with other indicators, such as the Relative Strength Index (RSI), to confirm that the market is not overbought and that there's room for growth.

On the flip side, exit points are equally important. They allow traders to lock in profits or minimize losses. A common strategy is to set a target price based on a certain percentage gain or a predefined resistance level. Additionally, using trailing stops can be an effective way to secure profits while allowing for some flexibility as the market moves. For instance, if a trader buys a stock at $50 and sets a target of $60, they might also place a trailing stop $5 below the highest price reached to protect against sudden downturns.

Moreover, it's essential to remain adaptable. Market conditions can change rapidly, and what might have seemed like a solid entry or exit point yesterday could become less favorable today. Therefore, regularly reevaluating your positions and adjusting your entry and exit points based on current market data is crucial. This adaptability not only helps in maximizing potential gains but also in minimizing risks.

In summary, defining entry and exit points requires a blend of strategy, analysis, and flexibility. By utilizing technical indicators and being responsive to market changes, traders can navigate corrections more effectively, ensuring they make informed decisions that align with their trading goals.

- What are entry and exit points in trading?

Entry points are specific price levels at which a trader decides to buy a security, while exit points are levels at which they choose to sell. - How do I determine my entry point?

Entry points can be determined through technical analysis, looking for signals such as breakouts, support levels, or specific chart patterns. - Why are exit points important?

Exit points are crucial for locking in profits and minimizing losses, helping traders manage their risk effectively. - Can I adjust my entry and exit points?

Absolutely! It's important to remain adaptable and adjust your points based on changing market conditions and new data.

Risk Management Strategies

When it comes to trading, especially during market corrections, having a solid risk management strategy is like having a safety net. It protects you from the unexpected twists and turns that the market can throw your way. Think of it as your financial armor; it helps you stay in the game even when the going gets tough. So, how do we craft this protective layer? Let's dive in!

First off, one of the most effective techniques in your risk management arsenal is position sizing. This is essentially determining how much of your capital you're willing to risk on a single trade. A common rule of thumb is to risk no more than 1-2% of your total trading capital on any one trade. This way, even if a few trades go south, your overall portfolio remains intact. For instance, if you have a trading account of $10,000, risking 1% means you would only lose $100 on a single trade. This approach not only protects your capital but also helps you maintain emotional stability during volatile periods.

Another crucial aspect is diversification. Imagine putting all your eggs in one basket; if that basket falls, you lose everything. By diversifying your investments across different asset classes, sectors, or even geographical regions, you can spread out the risk. For example, if you invest in both technology stocks and commodities, a downturn in one sector might be offset by stability or gains in another. This strategy can significantly reduce the impact of market corrections on your overall portfolio.

Next, let's talk about stop-loss orders. These are your automated safety measures that can help minimize losses. By setting a stop-loss order, you instruct your broker to sell a security when it reaches a certain price. This way, you can limit your losses without having to monitor the market continuously. For instance, if you buy a stock at $50 and set a stop-loss at $45, you automatically sell if the stock price falls to that level, thus preventing further losses.

Lastly, it's essential to regularly reassess your portfolio. Market conditions change, and so should your strategy. Take the time to evaluate your investments periodically. Are there stocks that are underperforming? Are your risk levels still in check? Adjusting your strategy based on current market conditions can help you stay ahead of the curve. Just like a captain navigates through stormy seas, you need to steer your portfolio through market corrections with a keen eye.

In summary, effective risk management strategies like position sizing, diversification, stop-loss orders, and regular reassessment can significantly enhance your trading experience. They not only protect your capital during market corrections but also instill a sense of discipline and confidence in your trading decisions. Remember, the goal isn't just to survive the storm but to come out stronger on the other side!

- What is position sizing? Position sizing refers to the amount of capital you risk on a single trade. It's crucial for managing overall risk in your trading strategy.

- How can I diversify my investments? You can diversify by investing in various asset classes, sectors, or geographical regions to spread out risk.

- What is a stop-loss order? A stop-loss order is an automated instruction to sell a security when it reaches a specific price, helping to limit potential losses.

- Why is it important to reassess my portfolio? Regularly reassessing your portfolio allows you to adapt to changing market conditions and ensure your investments align with your risk tolerance and goals.

Frequently Asked Questions

- What is a market correction?

A market correction is a temporary decline in the price of a security or market, typically defined as a drop of 10% or more from its recent peak. Corrections can occur in any market and are often seen as a natural part of the market cycle, helping to reset overvalued prices.

- How can technical analysis help during market corrections?

Technical analysis provides tools and indicators that help traders identify trends, potential reversals, and market sentiment. By analyzing price movements and patterns, traders can make informed decisions that mitigate risks during volatile periods.

- What are some key technical indicators to watch?

Key technical indicators include Moving Averages (like SMA and EMA), Relative Strength Index (RSI), and various chart patterns such as Head and Shoulders or Double Tops and Bottoms. These indicators provide insights into market behavior and potential price movements.

- How do I set stop-loss orders effectively?

To set stop-loss orders effectively, identify key support levels and consider market volatility. Establishing stop-loss levels based on technical analysis can help protect your investments from significant losses during corrections.

- What should I include in my trading plan?

Your trading plan should include clearly defined entry and exit points, risk management strategies, and criteria for reevaluating your positions. A well-structured plan helps maintain discipline and guides your decisions during market corrections.

- How can I recognize volume spikes?

Volume spikes can be identified by observing sudden increases in trading volume, often accompanying significant price movements. Recognizing these spikes can indicate heightened market interest and help traders anticipate potential corrections.

- What is the importance of risk management during market corrections?

Risk management is crucial during market corrections as it helps protect your capital from significant losses. Techniques such as position sizing, diversification, and adjusting stop-loss orders can minimize risks and enhance your trading strategy.